Here at Sales Cookie, we help our customers automate their sales incentive programs. At times, we come across situations where our customers want their reps to see how much commission they’ve earned per transaction. However, their plan structure is such that there isn’t a predictable per-transaction commission amount. This happens when using cumulative tiers, each paying a portion of total revenue.

What do you mean by sales transaction?

In our terminology, a sales transaction is any commissionable event. Sales transactions can be orders, invoices, contracts, opportunities, purchases, sales receipts, etc. It seems quite reasonable to expect some “commission amount” to be associated with each transaction, such as:

A per-transaction commission amount helps reps understand they have a stake in every sale, increases sales motivation, and simplifies analytics (ex: total commission paid by product, total commission paid by customer, etc.).

So why are you saying there may not be a per-transaction commission amount?

Many incentive plans have attainment tiers. For example, we could decide to pay 5% of revenue under quota, 8% of revenue at 100% to 150% of quota, and 10% of revenue above 150% of quota.

In this post, we assume that you want your tiers to be cumulative (i.e. progressive). For a given rep, part of their sales will be paid at the 5% rate, part of their sales will be paid at the 8% rate, etc.

The next question is here is whether you want to:

- Apply each tier’s percentage to a portion of total revenue within each tier? OR

- Apply each tier’s percentage to transactions which fall within each tier?

You can learn more about both approaches here. In this post, we assume that you want to apply rates to the portion of total revenue within the tier. For example, for each rep, you’d like the portion of their attained revenue under quota to be paid at 5%. And you’d like the portion of their attained revenue between 100% and 150% of quota to be paid at 8%. Etc.

For example, suppose that we had the following transactions during the month of June:

- Transaction #1 $50,000

- Transaction #2 $25,000

- Transaction #3 $30,000

Collectively, this represents 105K in revenue. Assume our quota is 100K. Therefore, we must pay 5% of 100K (revenue under the 100% quota zone), and 10% of 5K (revenue in the 100%-150% quota zone). As you can see, some portion of transaction #3 is in the under-quota zone, and some portion of the same transaction #3 is in the above quota zone. So what exactly is the commission for transaction #3? Hard to say.

Worse, we could decide to re-arrange transactions (ex: they all occurred the same day), and use the following order instead:

- Transaction #2 $25,000

- Transaction #3 $30,000

- Transaction #1 $50,000

Nothing has changed except for the order. Collectively, this still represents 105K in revenue. Therefore, we must still pay 5% of 100K (revenue in the under-quota zone), and 10% of 5K (revenue in the 100%-150% quota zone) – the same commission as before. However, it is now transaction #1 which “sits” between two quota zones, and so has a different amount associated with it. Ooops!

In conclusion, using cumulative tiers and the portion method means there isn’t a clear per-transaction commission amount. They contradict one another.

Need another proof?

Not convinced? Let’s suppose that there were some refunds. Your transactions now look like this:

- Transaction #1 $50,000

- Transaction #2 $25,000

- Transaction #3 $30,000

- Transaction #4 -$25,000

- Transaction #5 $25,000

- Transaction #6 -$25,000

- Transaction #7 $25,000

Below we’re showing the cumulative total. We are now crossing our quota threshold of 100K multiple times! So what exactly is each transaction’s commission? Of course, we can play the same game as before and re-arrange transactions (banks do this!) to get various results. So here you have it – another proof that using cumulative tiers and the portion method means there isn’t any per-transaction amount.

What is the solution?

Let’s say you REALLY want to have per-transaction commission payouts. Instead of paying commissions based on the portion of revenue within each cumulative tier, you can pay commissions based on which transactions fall within each cumulative tier. Then, we can calculate (and show) a per-transaction commission amount.

Keep in mind that transactions which “sit on the fence” between two tiers will have their entire amount counted towards the higher tier (and so be paid at the higher rate). Also keep in mind that we’ll first need to arrange transactions chronologically to determine which transaction falls within each tier.

Enough said. Let’s configure per-transaction commissions for each tier. Note that we selected the option to only process transactions within each tier. We’ll pay 5% for transactions which falls within the lower tier, and 7% for transactions which falls within the higher tier.

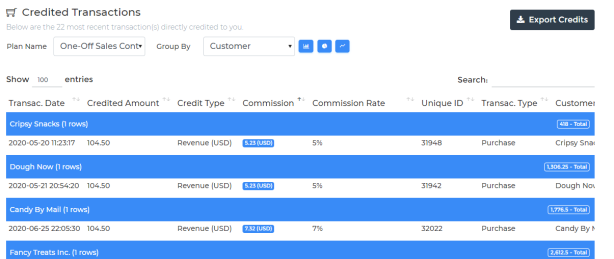

We now have a per-transaction commission we can show on incentive dashboards.

Can we improve further?

With the approach outlined above, transactions which “sit on the fence” (i.e. overlap two attainment levels) have their entire amount evaluated at the higher tier. However, it is possible to use blended rates where the transaction is magically split into two as it crosses tiers:

- Portion #1 – a portion of the transaction is evaluated as below the threshold tier

- Portion #2 – another portion of the transaction is evaluated as above the threshold tier

Sales Cookie can do this automatically for you. Simply select this option on your plan:

There is a tricky situation where a single (large) transaction causes the running total to cross multiple tiers. In this case, Sales Cookie will split the same transaction multiple times, each tier receiving a portion of your large transaction.

Here is an example where a transaction was split in two. One portion of revenue was paid at the 5% rate, and another portion of revenue was paid at the 7% rate. About 90% of this transaction’s amount qualified for the 7% rate, and about 10% qualified for the 5% rate.

In Conclusion

Many organizations want each sales transaction to have an associated commission amount. When using cumulative tiers which pay a portion of total revenue, there isn’t a clear per-transaction commission amount. Simply re-arranging the order of transactions proves this.

Customers who require per-transaction commission amounts should NOT use cumulative attainment tiers which pay a portion of total revenue within each tier. Instead, they should use per-transaction commissions. Payouts will then be based on which transactions fall within each tier. Transactions which “sit on the fence” between two tiers will have their entire amount counted towards the higher tier (and so be paid at the higher rate).

One improvement consists in enabling blended commission tiers. Sales Cookie will then magically split commissions for you as they cross tiers. All you have to do is apply a payout rate to each tier. Your reps will see a portion of each overlapping transaction being processed at a different rate.

Visit us online to learn more about commission split, attainment tiers, and more!