Are you thinking about switching from a YTD commission structure (with monthly payouts) to a QTD commission structure (also with monthly payouts) or vice-versa? Here at Sales Cookie, we are passionate about sales commissions and automation. In this blog post, we compare both approaches. Please reach out if you feel we missed something or have more insights you’d like to share. We’d love to hear from you!

Payout Timing & Predictability

With YTD commission plans, reps often earn larger commissions towards year end. Indeed, they must first retire sufficient quota before they become eligible for higher tiers. With a YTD structure, this can take months. With QTD plans, on the other hand, quotas are reset every quarter. Therefore, reps have several opportunities to reach higher commission tiers during the course of a year.

A typical YTD commission payment profile looks like this:

A typical QTD commission payment profile looks like this:

Here, the advantage goes to QTD plans because commissions are better distributed over time. The average spend is more evenly spread (vs. being heavily weighted towards year end). In fact, YTD plans can result in bad surprises. In December, one might discover that many reps crushed their YTD quotas, making you liable to pay much larger commissions than previously within the same year. For this reason, a YTD commission structure can make commission spend budgeting a bit more difficult.

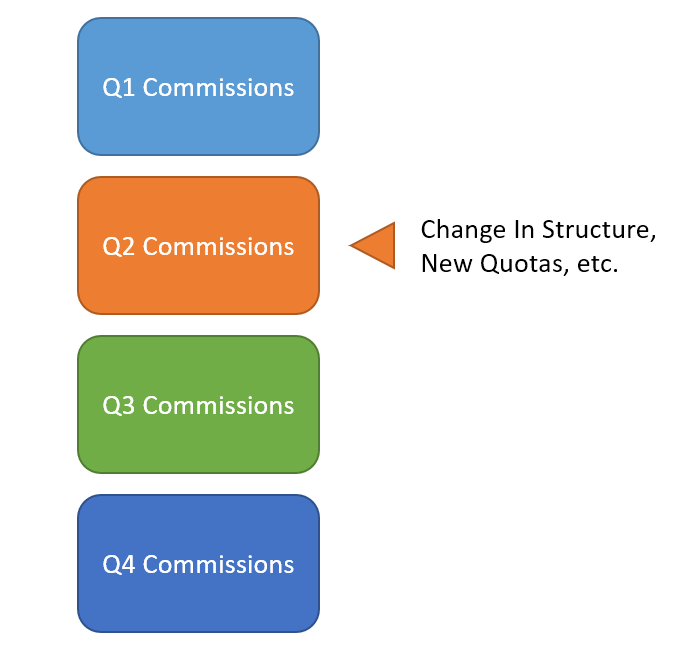

Commission Agility

QTD plans give you an opportunity to change your commission structure more frequently (ex: every quarter). Using YTD plans, it’s more difficult to change plan parameters (ex: quotas, crediting rules, payout rules, etc.). If your reps are on a YTD plan, they’ve been working for months towards retiring a large annual quota. Changing quotas mid-period may prove challenging. The same applies to payouts or crediting. If a change is made mid-year, YTD plans must deal with both “old” (backward-compatible) and “new” (forward-compatible) commission rules. With QTD plans, you can isolate the complexity of dealing with changes within a single quarter.

Once again, the advantage goes to QTD plans because they allow you to more easily make adjustments, add or remove spiffs, and better respond to unique situations (ex: an economic crisis, a competitor going out of business, a territory re-design, etc.).

Impact On Rep Motivation

Here are some things to consider:

- Whether you use YTD or QTD plans, there will be some type of “reset”. Reps will be assigned new quotas and start all over from scratch. With YTD plans, this reset happens every January. With QTD plans, this reset happens every 3 months. With QTD plans, this reset is more frequent but less abrupt. With YTD plans, most reps earn their highest commissions towards year end. Therefore, starting from zero in January is often a bigger letdown than starting from scratch every quarter.

- With QTD plans, some reps may try to manipulate the timing of deals, so that they “magically” appear with a specific quarter (with the hope of earning higher commission rates within a quarter). With YTD plans, this type of manipulation is meaningless. However, QTD plans help you motivate your reps to close as many deals as possible each quarter (vs. just in Q4).

- With YTD plans, it might take your reps several months of hard work before they become eligible for higher commission rates. Some may get discouraged because their hard work isn’t being rewarded along the way. QTD plans provide an opportunity for more immediate rewards. Also, higher performers might get too comfortable if they know they are now eligible for higher rates (no matter what happens). QTD plans tend to create more sales motivation.

- As mentioned previously, YTD plans have a different spend profile from QTD plans. What do your reps like? Do they prefer more lavish payouts in December? Or do they prefer to crush it every quarter and have a shot at exciting payouts every 3 months?

Impact On Spend

As previously mentioned, YTD plans leave the door open to bad surprises. In December, you might discover that many reps crushed their YTD quotas, making you liable to pay large commissions. Using QTD plans, you have an opportunity to more frequently adjust quotas, adjust payouts, etc. This can reduce your overall spend because, after all, you’re not committing to a commission structure for a whole year.

One advantage of YTD plans, however, is that only committed reps can become eligible for higher commission tiers. If a rep works 4 months at your company and leaves, it’s unlikely they would have qualified for higher commission rates. So, you won’t overspend on reps whose tenure was short. This said, you may find it easier to retain high performers if they don’t need to wait a whole year to see the benefits of their hard work.

Are Quarters Too Short To Measure Performance?

One characteristic of YTD plans is that they measure performance over the course of an entire year. Therefore, you may wonder whether 3 months is too short to accurately measure sales performance. The answer is – probably not. Even if a rep goes on vacation for 2 full weeks during one quarter, their active time still represents 89% of a normal working quarter. This may be more of an issue if you have employees with extended leaves.

With YTD plans, a rep could take an entire month off, and make up for lost time months later. However, if you want to encourage more sustained (and reproductible) performance, a QTD approach makes more sense. In short, do you want your reps to run a marathon, or sprints? With a marathon, some reps may get discouraged, take along break, or give up.

Calculating QTD / YTD Commissions With Monthly Payouts

Here we’ll focus on calculating commissions for QTD plans, but this is equally valid for YTD plans.

There are two primary ways you can measure QTD sales performance, yet pay commissions more frequently (ex: monthly, weekly, etc.):

- Approach 1 – with deductions

- Approach 2 – without deductions

Approach 1 – With Deductions

We will always re-calculate from quarter start. Each month, we will re-evaluate all sales QTD, determine attainment for each target, and calculate the total commission due – QTD to each payee. However, we will deduct what has already been paid in previous months within the quarter.

Let’s say you already calculated commissions for January 1 to January 31. You now want to calculate February commissions. We will process sales from January 1 to February 29, determine QTD attainment, and calculate the total commission due QTD to each payee from January 1 to February 29. And then, we will deduct what was already paid in January (so that you don’t double-pay commissions over January sales).

Approach 2 – Without Deductions

We will always calculate from quarter start. We will evaluate all sales QTD, and determine attainment for each target. However, we will only issue commissions for sales within the current calculation period.

Let’s say you already calculated commissions for January 1 to January 31. You now want to calculate February commissions. We will process sales from January 1 to February 29, and determine QTD attainment. However, we will only calculate commissions for February sales. No deductions are required.

To learn more about how to configure plans for QTD and YTD scenarios, please review the following articles:

https://support.salescookie.com/en/article/recipe-how-to-setup-a-monthly-plan-with-qtd-attainment

https://support.salescookie.com/en/article/recipe-how-to-setup-a-monthly-plan-with-qtd-attainment

In Conclusion

QTD plans are preferable to YTD plans because of the following characteristics:

- Commission agility. Each quarter is an opportunity to adjust things. You’re not committing to one structure for a whole year.

- More even spend. Payouts are more evenly distributed over time vs. skewed towards a heavy Q4.

- More motivating. Each quarter, your reps have an opportunity to earn higher commission rates vs. patiently waiting for year end.

Some of the downsides of QTD plans include:

- Reps don’t need to complete an entire year of service to earn higher commissions. This may be a problem if turnover is high.

- Some reps can manipulate the timing of closed deals so that they appear within certain quarters. This is meaningless with YTD structures.

- Reps can’t take extended breaks because they are running sprints, not a marathon.

Visit us online to learn more about sales commission automation!