Are you responsible for sales commissions but don’t have time to learn all the terminology? Or, perhaps, you are on the receiving end of sales commissions, but someone used terminology which you found confusing? Here are practical definitions to help you make sense of all this. After reading this, you’ll be able to follow any discussion about sales commissions! Visit us online to learn more about automating your commissions. For a more complete overview, read our guide about defining commission plans.

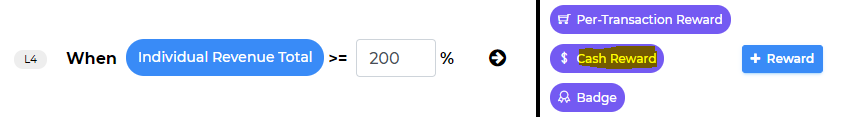

Accelerators – Accelerators afer just one type of “kicker”. They usually take the form of higher commission rates, which are only applicable to higher levels of attainment. Example: “Our SDR plan includes an accelerator – after reaching 150% of quota, you will receive an additional 1% per deal (in addition to the regular 5%)”.

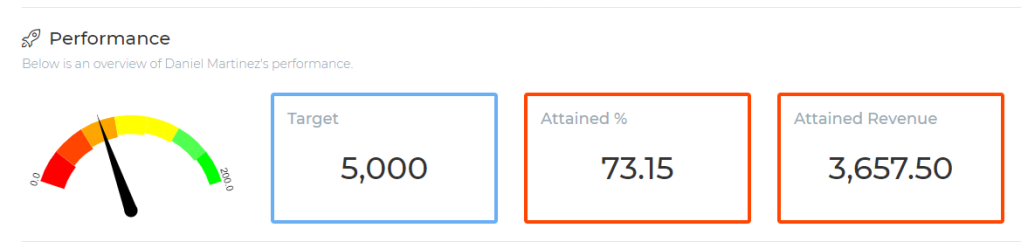

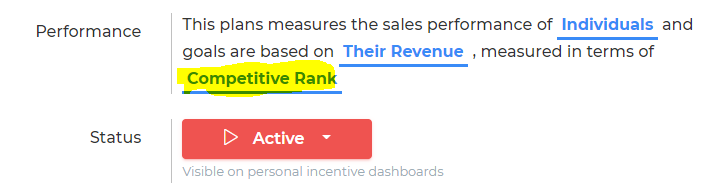

Attainment – Attainment represents achievement vs. a sales performance goal for a specific time period. Often, each rep’s attainment is measured using “credits” (see definition below). Typically, credits and attainment impacts commission amounts or rates. Attainment can be measured using absolute values (ex: attained total revenue), or in relation to a quota (ex: % of quota attained). More advanced types of attainment are also possible (ex: competitive ranking, year-over-year growth, etc.). Example: “Sara did great last month – her attainment was 125% of quota”.

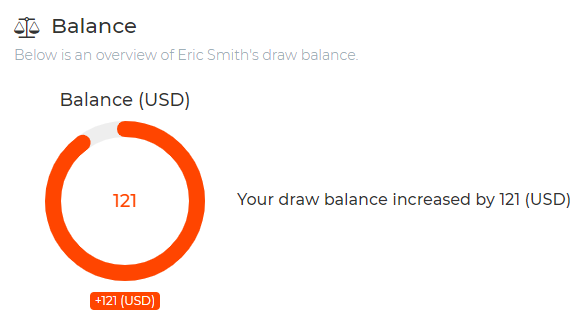

Balance – When reps are granted recoverable advances, they have a repayable debt to the organization. Each rep’s balance tracks how much they owe. A rep’s balance may go up (when recoverable amounts are granted), or down (when repaid by the rep). Example: “John has a balance of $1000 because he received two advances of $500 this month and last month”.

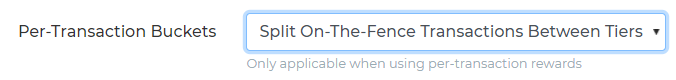

Blended Rates – Suppose that you have 2 attainment tiers. Under quota, the payout is 5% of revenue. Above quota, the payout is 10% of revenue. Now, there could be a situation where a single (potentially large) deal crosses tiers. A portion of the deal’s amount is effectively under the quota threshold. Another portion of the deal’s amount is effectively above the quota threshold. Enter blended rates. Each tier’s commission rate is applied to a portion of the deal. Example: “Your blended rate on this deal is 7.5%, because 50% of revenue was paid at 5%, and 50% of revenue was paid at 10%”.

Bonus – Often, commissions are calculated on a per-deal basis. Each per-deal commission can be a fixed amount (ex: $100 per deal), or a percentage (5% of revenue). However, there are cases where rewards need to be lump-sum amounts. In this case, payouts are not per-deal, but cash amounts. Note that bonuses can create problems if you must track how much commissions were paid on a per-deal basis for accounting purposes (ASC 606, amortization, etc.). Example: “Jane is getting a $1,000 bonus for winning this week’s sales contest”.

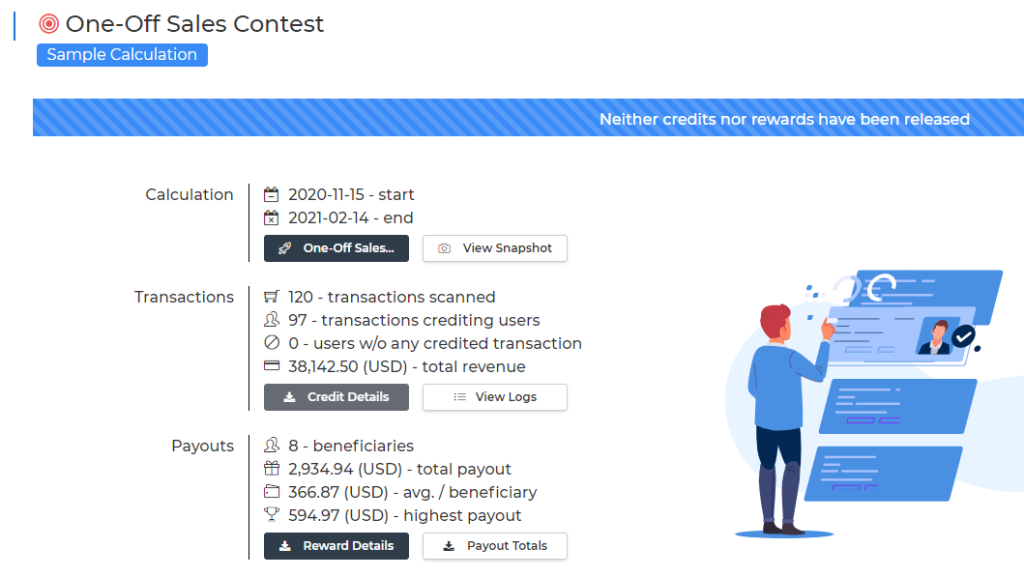

Calculation – A calculation consists in calculating commissions for one specific incentive plan and calculation period. For example, if you have a quarterly AE bonus plan, you will have a Q1 calculation, a Q2 calculation, a Q3 calculation for the same AE bonus plan. Each calculation determines which transactions fall within the calculation period, what the attainment is for each target, and what payouts should be. Example: “We’ll need to re-calculate Q1 commissions for AEs because we received updated December sales data”.

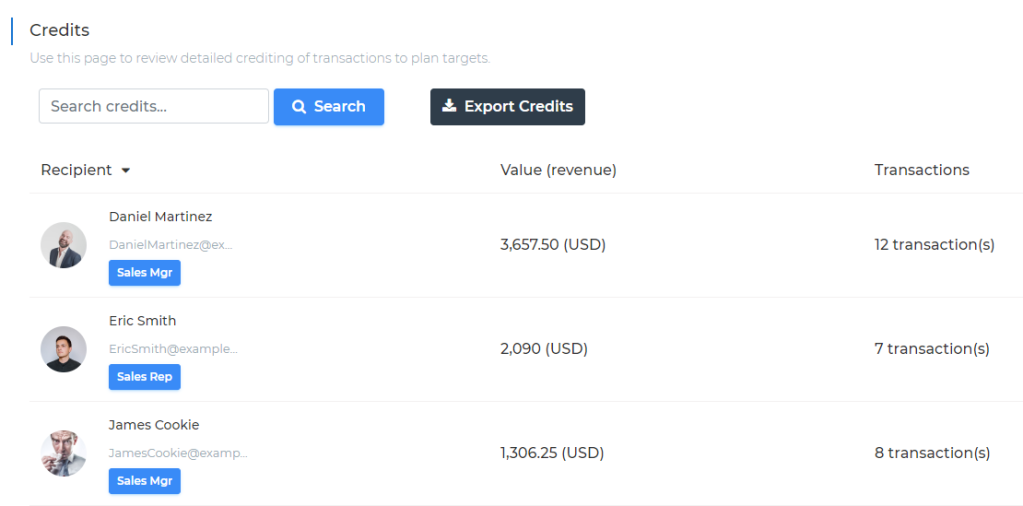

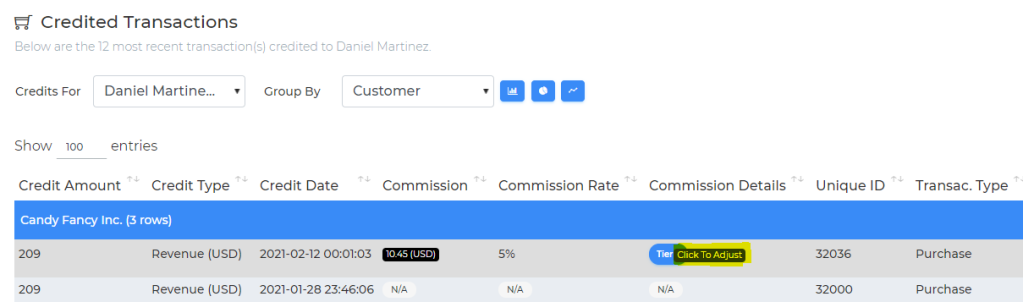

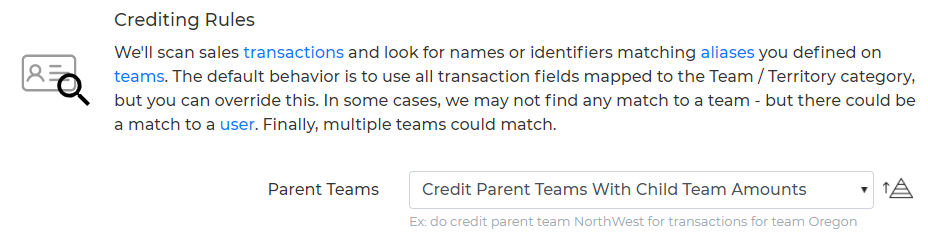

Credits – Crediting is the action of attributing deals to reps for the purpose of calculating commissions. When a rep is credited with a deal, this impacts their attainment. Reps may be credited directly, for example because they own deals. Or, reps may be credited indirectly, for example because they manage a territory or other reps. Credits can be expressed as total revenue (ex: $50,000 in credited revenue), or other metrics (ex: 10 appointments, 20% margin growth, etc.). Example: “Bob was credited with 10 sales last month, representing $25,000 in total margin”.

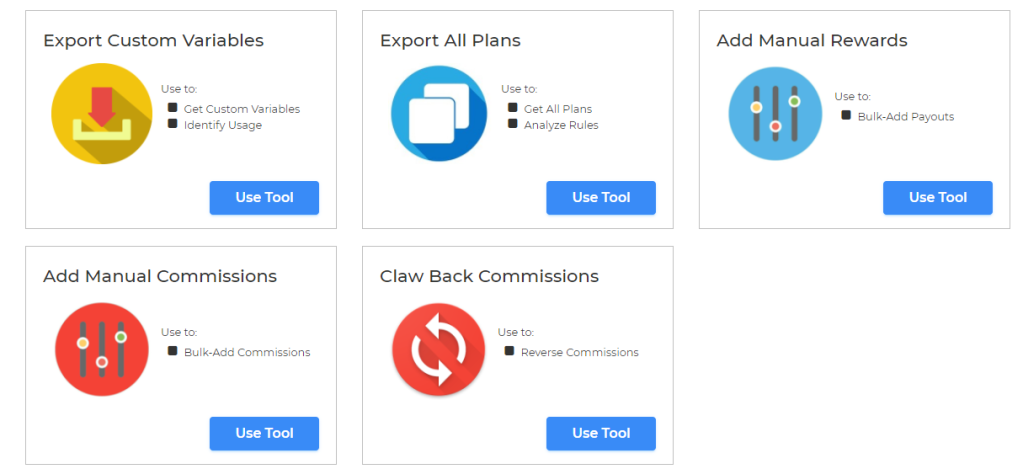

Claw-Back – A claw-back consists in recouping paid commissions following an adverse event (ex: a cancellation, a refund, non-payment, etc.). An alternative name for claw-backs is charge-back. Claw-backs can be easy or difficult to implement, depending on the trigger (ex: non-payment after 2 months), charge-back amount (ex: fixed vs. prorated), and repayment rules (ex: use paid commissions to cover claw-backs). Example: “We should issue claw-backs for Terry because we didn’t receive payment for 2 of his invoices and we pre-paid commissions on those”.

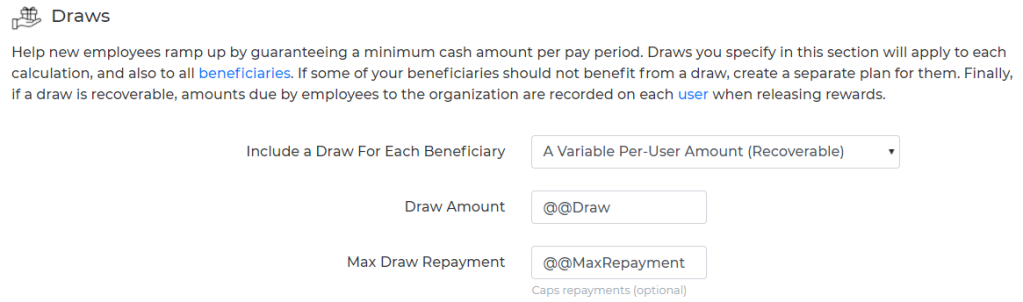

Draw – A draw is equivalent to a minimum commission guarantee – essentially an advance. Draws are common for new employees whose payouts may remain low while ramping up. When a rep’s earned commissions fall below a certain limit, some “padding” commission amount may be granted in the form of a draw. Draws can be recoverable (i.e. they need to be repaid), or non-recoverable (i.e. they are forgiven). Example: “All new employees will receive a recoverable draw of $5000 per month while in training – repayment will start as soon as covered by commissions”.

Draw Repayment – A draw repayment occurs when a rep was previously granted recoverable payouts / advances, and their owed balance is being repaid (partially or in-full). Typically, recoverable amounts are only repaid by commissions (not deductions from salary). Sometimes, the draw repayment amount is capped, making repayment more gradual. Example: “Eric repaid $100 from his owed recoverable balance last period – his commission was $1100, with a repayment maximum of $100 per period“.

Earned Commissions – There is no standard definition of “earned commissions”. Some organizations declare commissions as “earned” as soon as they are calculated, but those “earned” commissions won’t be paid unless payment is received. Other organizations declare commissions as “earned” only if they have been fully processed by payroll. We recommend not using this terminology because it is confusing, and can cause legal headaches (ex: you declared commissions as “earned” and are now legally required to pay them).

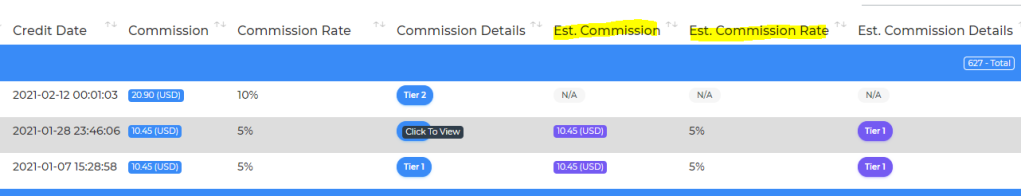

Estimated Commissions – An estimated commission is an expected commission, but only an approximation. This is common in situations where commissions are estimated based on CRM opportunity amounts, but payment of actual commissions depends on payments being received from customers. Often, the actual amount received from customers differs from the CRM opportunity amount (for example due to taxes or discounts). Estimated commissions allow your reps to forecast and track expected payouts.

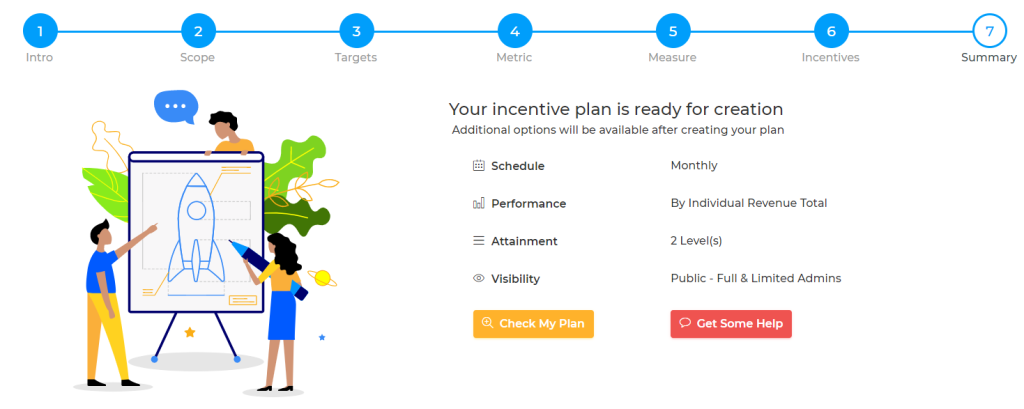

Incentive Plan – An incentive plan represents a commission structure (i.e. a way to pay commissions). Each plan measures some type of performance (ex: finding leads, closing deals, booking appointments, etc.) over a certain period, and assigns rewards based on attainment. Each plan will also have a list of eligible payees, often based on role. Example: “The STM bonus plan is for senior territory managers only, and pays commissions monthly, based on year-over-year territory revenue growth”.

OTE – On-target earnings (also known as OTE or “on-track” earnings) represent expected earnings for a given role when all expected performance goals (ex: quotas) are satisfied. OTEs help reps estimate what their commission should / could be, and help organizations define a commission budget as well. Example: “For this role, the base pay is $50K, and the OTE is $30K at 100% of quota”.

Override Commissions – There are two possible meanings for “override”. The first definition of override commission is commission received by managers based on some type of rollup (ex: team rollup, territory rollup). Example: “VPs will receive a 0.5% override commission on all sales within their territories”. The second definition of override commission is an exception to a calculated commission. Example: “We’ll need to override Bob’s commissions because one deal had the wrong amount”.

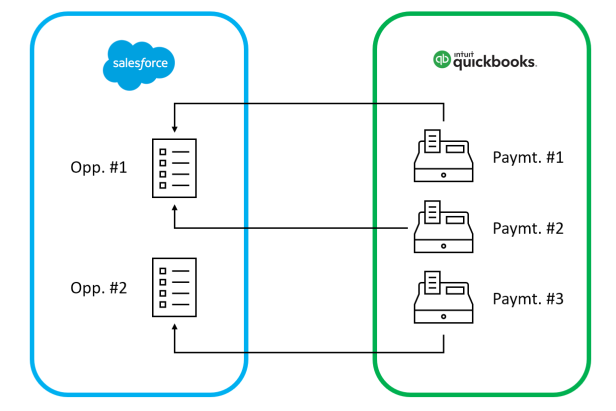

Pay When You Get Paid – A commission structure where closing deals drives attainment (and so estimated commission payouts), but actual payment of commissions is delayed until payment is received from customer. This often involves two systems (ex: a CRM and an Accounting system) and two types of records (ex: CRM opportunities and Accounting invoices). Example: “For this plan, attainment is measured using SalesForce closed opportunities, but commissions are issued when payment is received within QuickBooks“.

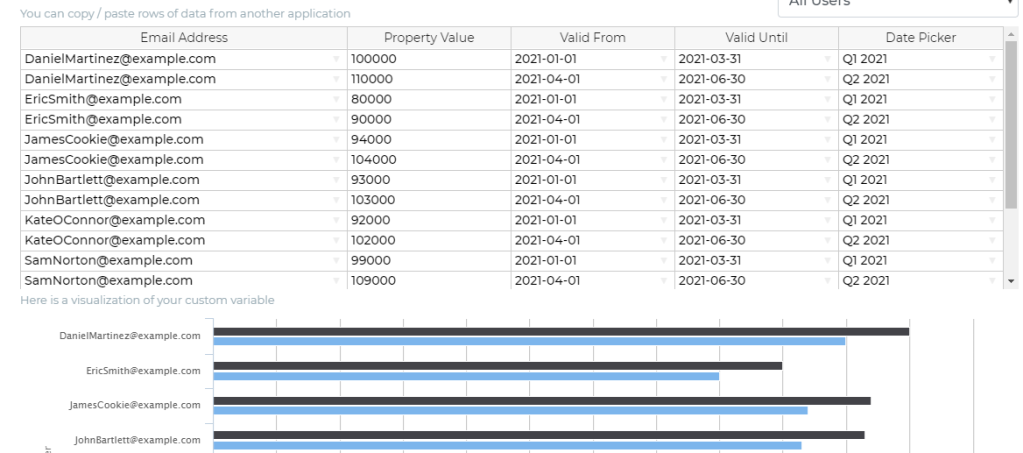

Quotas – Quotas are sales goals which are valid for a specific time period. Quotas can be expressed using revenue (ex: $50,000 / quarter), or other metrics (ex: 10 appointments / week). Often, quotas impact commission amounts or rates. Also, quotas typically change over time. In some cases, reps are expected to meet quota before they receive meaningful commissions. Example: “Joe’s quota for Q1 is $50,000 in total revenue, with a 0.5% payout under quota, and 5% above quota”.

Quota Retirement – When reps are credited with deals, they receive attainment via credits (see definition above). Their attainment is used to retire their quota. The idea here is that commissions will remain lower until quotas are met (i.e. retired). The idea of retiring quota is more common for incentive plans which are YTD or QTD, because quotas tend to be large and retiring the quota represents a significant milestone. Example: “Ted already retired his annual quota – his sales were $110,000 for an annual quota of $100,000”.

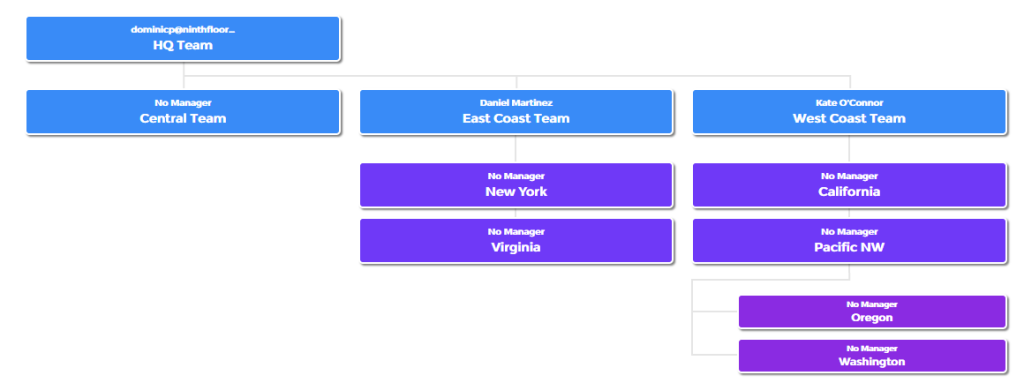

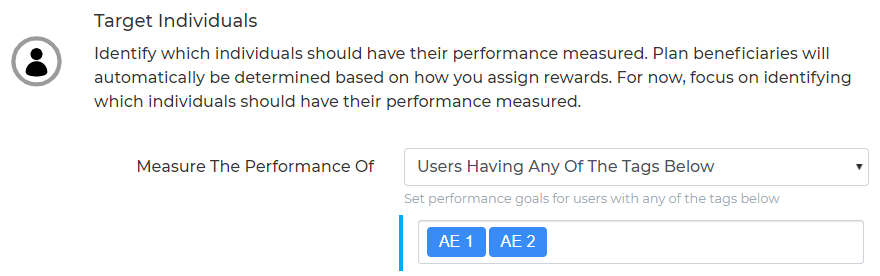

Plan Targets – To define a commission structure, you have to measure sales performance. You could measure the performance of specific individuals, or you could measure the performance of specific territories / teams. Those individuals or teams are plan targets. Note that payees may differ from targets. For example, you could measure the performance of teams (so those teams are plan targets) but pay managers. Or you could measure the performance of individuals (so those individuals are plan targets) but pay their managing VPs. Make sure to use a solution which offers this level of flexibility.

Ramped Quotas – A ramped quota is a quota which gradually increases over time. Ramped quotas are often used to artificially reduce quotas for new employees while ramping up (ex: building a new pipeline of deals). Often, the ramped quota is calculated based on current employment duration. Example: “New employees will receive a ramped quota, which is 30% of their regular quota for their first month of employment, and 60% of quota from their second to fifth month of employment”.

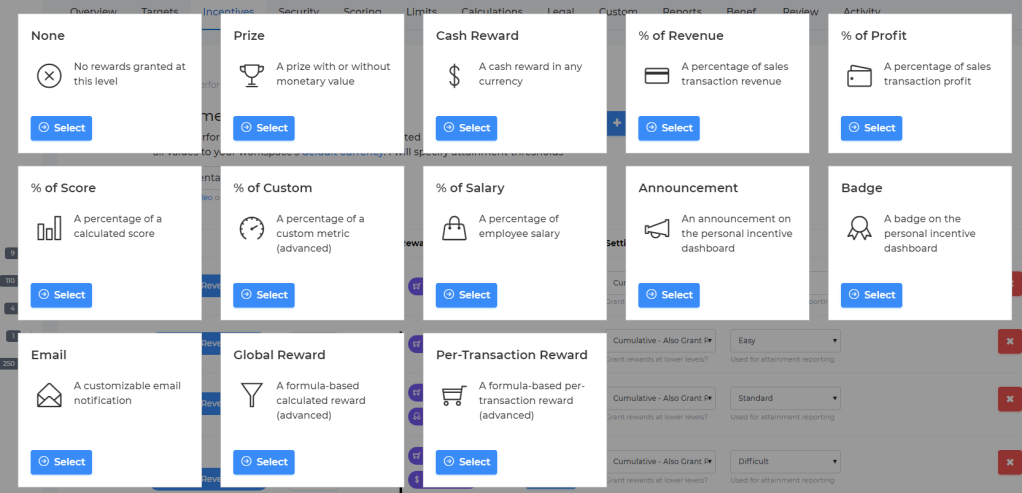

Reward – A reward is equivalent to a commission payout, but a bit more general. For example, rewards may include non-monetary incentives such as perks, badges, emails, prizes, etc. Example: “Reps who attain 150% of quota in Q1 will receive an extra 2% commission for all their Q2-Q4 deals”.

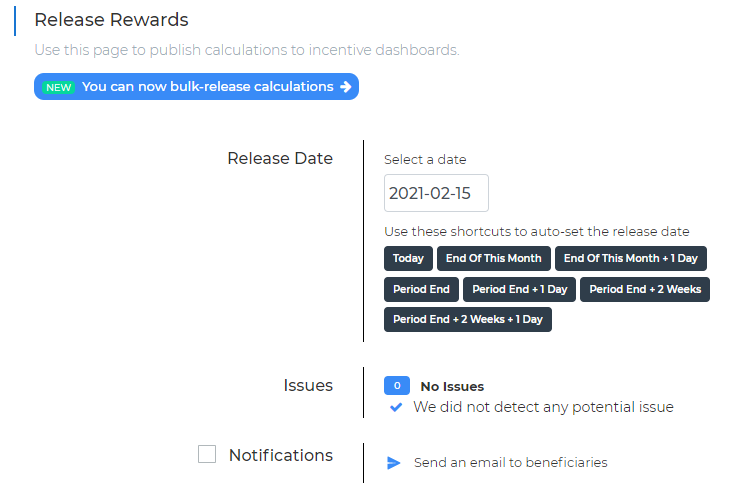

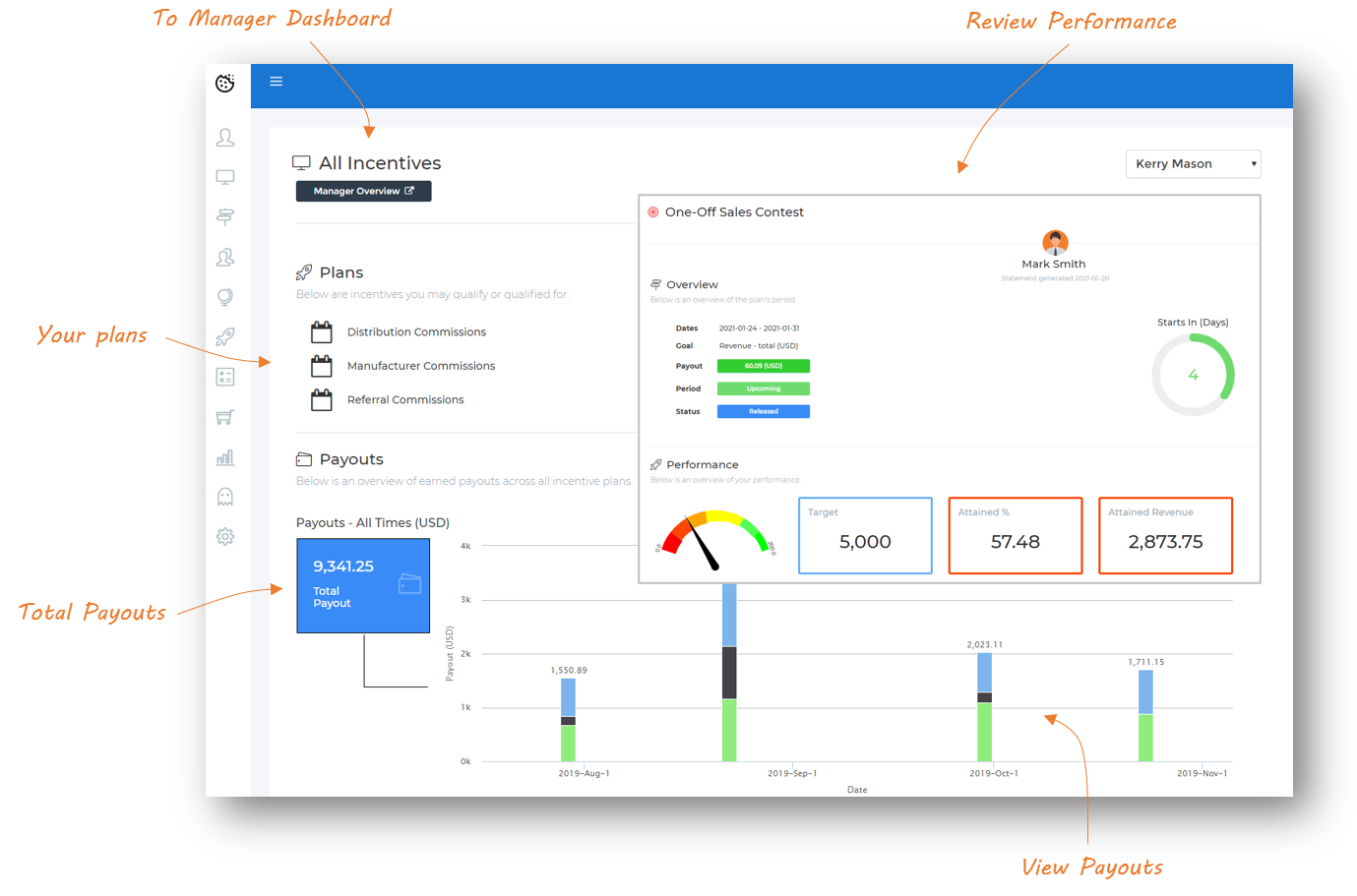

Release – After calculating commissions (manually or automatically), you have to decide when to publish commission statements to your payees. The release process consists in publishing either intermediary (ex: mid-period), or final (ex: frozen) commission statements to your payees. With manual spreadsheets, you would manually distribute them, or send them via email. With an automated commission system, you would release them to your reps’ online dashboards.

Rollups – Whenever there is some type of hierarchical structure, there is an opportunity for rollups. The rollup may apply to crediting, and/or to payouts. For example, territory managers could have their performance measured based on how each region they manage performs. Or, a VP of sales may be paid based on commissions received by his/her employees. Example: “For the purpose of crediting, each regional VP will be credited for all strategic sales within their territory hierarchy”.

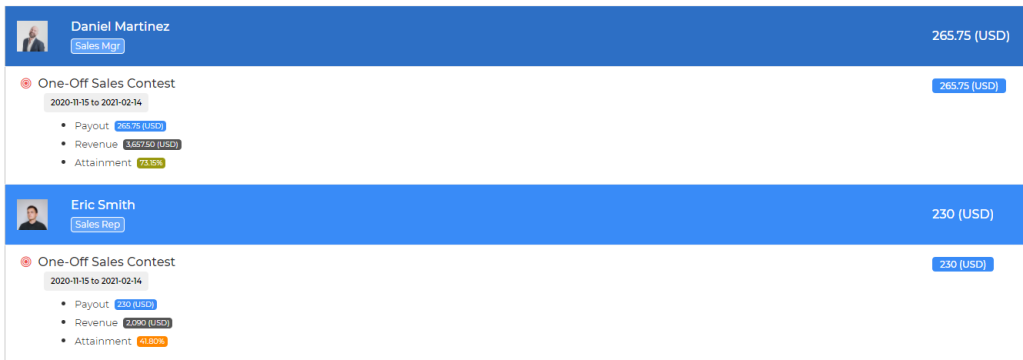

Sales Contest – A sales contest is a type of incentive plan which is based on relative performance (i.e. a rank). Based on each rep’s ranking, the highest performers will receive rewards. Sales contests are often used to promote friendly competition. Example: “Next month, we’re having a sales contest for APAC SDRs – the SDR who books the most appointments will win a trip to Mexico”.

Spiffs – A Spiff is a special one-off incentive. Spiff is sometimes understood as “Special Performance Incentive Fund”, and sometimes as “Special Performance Incentive Fund”. Therefore, there is no single definition of Spiff (other than being special). Typically, spiffs are allocated from a unique budget, are limited in duration, and exist in addition to mainline commissions. Example: “In Q1, we’ll include a $5,000 spiff for the person who closes the most deals”.

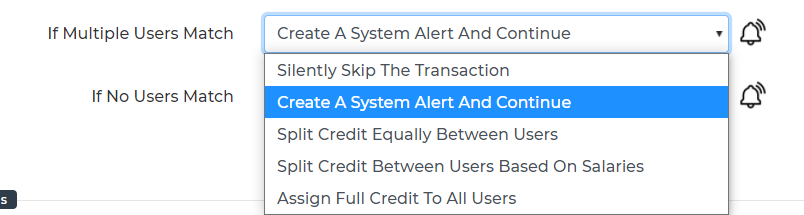

Splits – A split happens when 2 reps with the same role receive commissions on the same deal. The split may be a crediting split (ex: each rep gets credited half the deal’s amount). Or, the split could be a commission split (ex: each rep gets credited for the full deal’s amount, but only receives half their calculated commissions). Example: “Bob and Janes are splitting commissions on this deal”.

Statements – Most organizations provide periodic commission statement to all payees to inform them of their payouts and to increase transparency. Those statements can be spreadsheets with attainment, payouts, etc. Most statements include a time period and explanations as to how commissions were calculated. More detailed statements can include a list of deals, per-deal commission rates, split details, etc. Example: “We’ve now generated all February commission statements for the APAC team, and are ready to send them”.

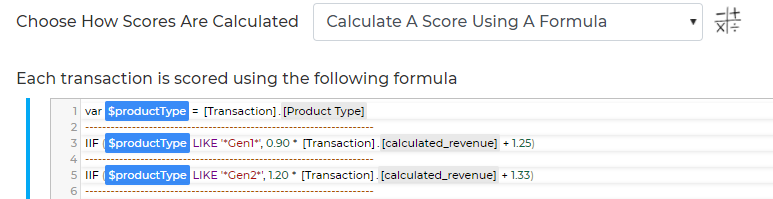

Score – While most incentive plans use revenue or profit to measure sales performance, some plans need to “count” commissionable events (ex: the number of appointments booked, the number of deals originated, the number of solar sale installations completed, etc.). For those cases, using a score makes sense. Often, the calculated score is simple (ex: 1 point per appointment). However, some organizations may require more sophisticated scoring. Example: “Reps will be credited with 90% of revenue for gen-1 products, and 120% for gen-2 products, because we want to promote sales of gen-2 equipment”.

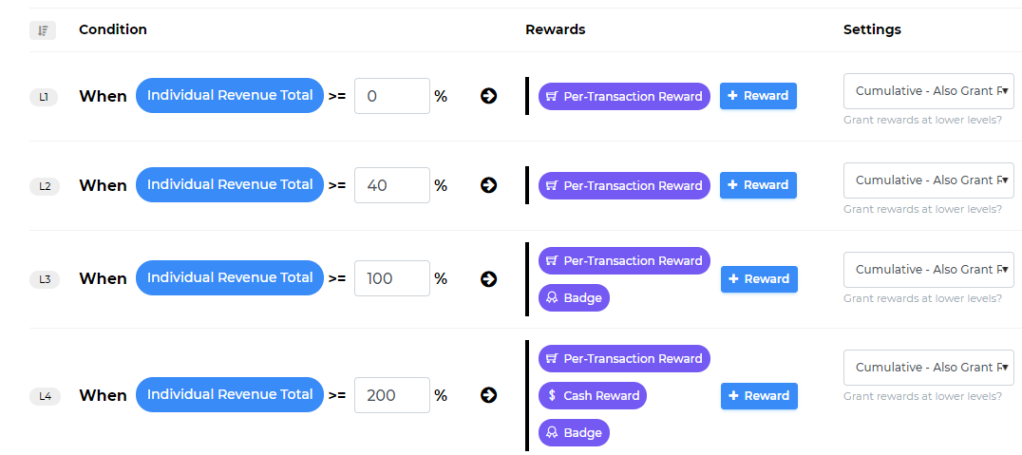

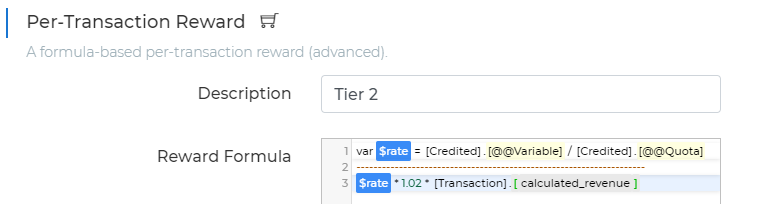

Tiers – Many incentive plans measure attainment, and define nuanced payouts depending on attainment. Tiers define bands of attainment, each having associated rewards. Tiers can be cumulative (in which case lower attainment tiers will also have their rewards triggered), or non-cumulative (in which case only the highest attained tier counts). Also, each tier may pay commissions over all transactions, or only over in-band transactions. Example: “Our AE plan has 4 cumulative tiers – below 40% quota, 40-100% quota, 100-200% of quota, and 200+% quota”.

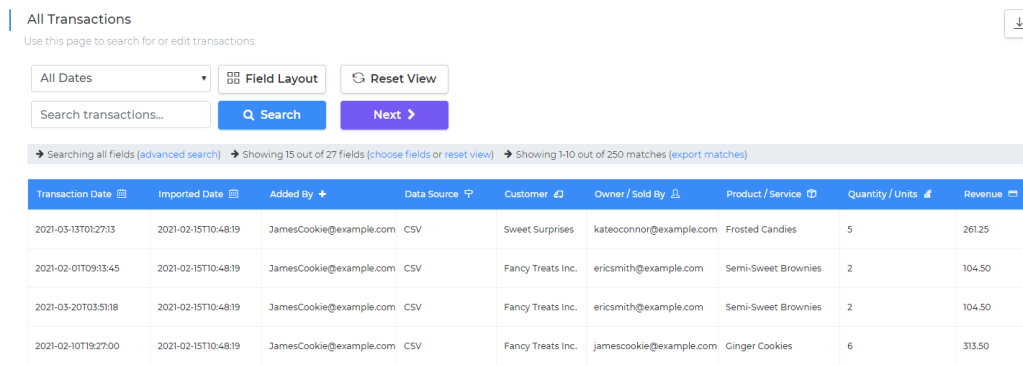

Transactions – To measure sales performance, you could use invoices, deals, opportunities, orders, bookings, appointments, payments, leads, credit memos, sales receipts, etc. A transaction represents any of those! More generally, a transaction is a commissionable event. Example: “To calculate commissions, we’ll import SalesForce orders and QuickBooks payments as transactions”.

Variable – A rep’s variable is their total expected commission amount at 100% quota attainment. Typically, reps have both a base salary component, and a variable component. The variable component will be received in full if performance is at the “expected” level. Often, base commission rates are calculated by dividing rep variables by corresponding quotas. This way, attaining 100% of quota means paying the variable in full. Example: “Martha’s variable for January is $1,000, and she has a monthly quota of $10,000, so her commission rate is 10%”.

Withholdings – Sometimes, commissions are calculated but remain unpaid until actual payment is received from customers. In this case, commissions are essentially withheld until approved. Your reps should have a way to track which deals are awaiting payment. Example: “Fred has 3 commissions awaiting payment from customers”.

In Conclusion

Did we miss some important commission-related definitions? Let us know by visiting us online and leave us a message. We’d love to hear from you!