Do you work for an insurance company? Are you responsible for commissions? In this blog post, we’ll describe key mechanisms insurance providers can use to implement a successful sales incentive program. We’ll also explain some key advantages automation can bring to your business.

When Should Insurance Commissions Be Paid?

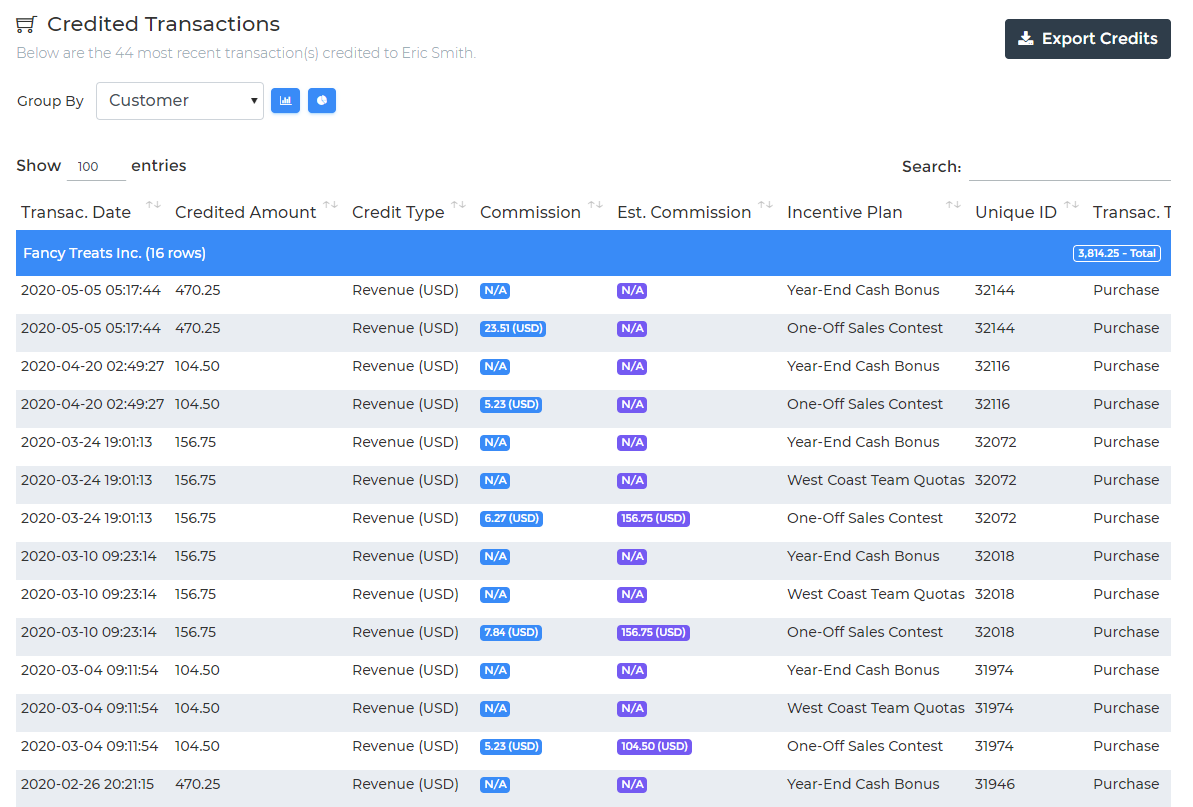

First, let’s talk about the timing of commissions. Most insurance providers only issue actual commissions when policies become active (not when just submitted or approved). Using an automated system, insurance providers can show an estimated (potential) commission amount as soon as policies are submitted or approved. This allows agents to track how much commission they could earn on policies before conversion. This is an excellent way to motivate agents and improve retention.

Other insurance providers prefer to issue commissions earlier – for example, as soon as policies are submitted or approved. This is less common because policies often fail to convert to active policies. When policies fail to convert, previously issued commissions must be clawed back, which increases complexity. This is the main reason why insurance providers typically only pay commissions when policies become active, as there is degree of confidence that the policy will go through.

Other providers may choose to pay commissions incrementally based on actual payments received from customers. Keep in mind that new agents need time to build a pipeline, so if they have to wait for actual payment, they may be left starving. You can always provide commission draws (commission guarantees) to help them while ramping up.

To recap, the following three choices are available in terms of commission timing:

- Issue commissions only when a policy becomes active

- Show an estimated (potential) amount when a policy is submitted or approved

- Issue commissions early when a policy is submitted or approved, based on its annualized premium

- However, there will be a claw-back (chargeback) if the policy fails to convert

- Issue commissions incrementally when each payment is received

- Based on received payment amounts

How Should Failed Conversions Impact Commissions?

In the insurance business, many policies will either:

- Be submitted, but won’t be approved

- Be approved, but won’t convert to active

- Be active, but won’t remain active (ex: policy cancelled, policy suspended, failed payment, etc.)

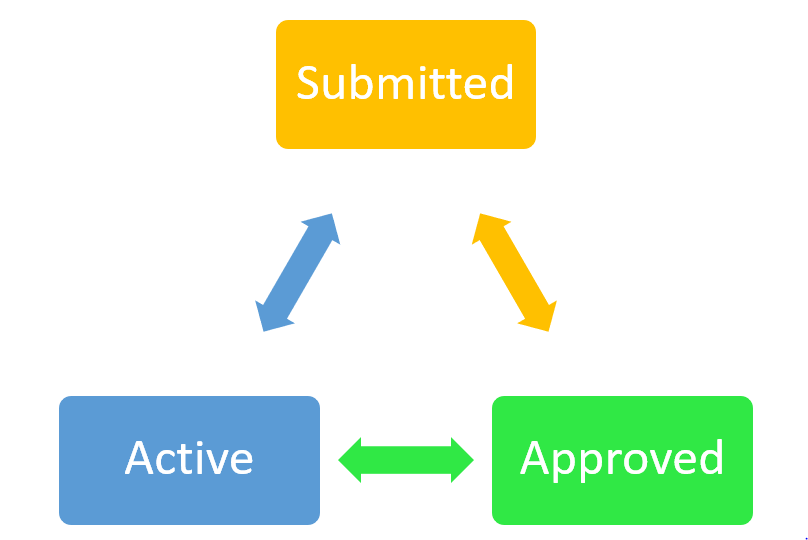

Such state transitions may happen multiple times. A single policy may be approved, then fail to receive approval. After re-submission, the same policy may become active. Later, it may be suspended due to payment issues. Finally, it may go back to active because payment issues have been resolved. To properly handle state changes and their impact on commissions, insurance providers use one of two main strategies described below.

The first strategy uses claw-backs (aka chargebacks) and repayments. When a policy goes active, an initial commission amount is issued. If the policy is no longer active, the previously issued commission amount is clawed-back. When the policy becomes active once again, the original commission amount is repaid. This dance may happen multiple times during the lifetime of a single policy. Note that claw-backs and repayments may be for the full amount, or only for a pro-rated portion. One benefit of automation is that it can provide a commission “memory”, which can be used to correctly calculate and issue commissions, claw-backs, and repayments.

The second strategy is escrow with periodic adjustments. Using this model, commissions are paid upfront, but a portion of the commission amount is held in escrow. Occasionally (ex: every quarter), the insurance provider re-examines policies, and makes adjustments to commissions. If a policy is still active, the amount held in escrow is released. If the policy is no longer active, the entire amount paid in commissions is clawed back.

One question remains however. How much to hold in escrow? Most insurance providers use a flat rate of 10-30%. Other providers may calculate a per-agent percentage, based on performance. For example, if an agent has a proven and consistent high conversion (retention) rate, then this agent’s escrow rate may be reduced, for example from 20% to 5%. There are many possible ways to calculate an agent’s retention rate and so determine their escrow percentage. This retention rate could be calculated from policies sold over the prior months, either using policy counts or premiums.

Which Goals Make Sense For Insurance Commissions?

Most insurance providers set performance goals based on a/ the total count of policies sold or b/ the total premium sold. Some insurance providers use non-cumulative tiers. Using this model, only the highest attained tier matters, and all the policies are paid at the same rate. Other providers use cumulative tiers. Using this model, policies which fall within the first tier (ex: 1-10 policies) are paid at a certain tier, policies which fall within the next tier (ex: 11-20 policies) are paid at a different tier, etc.

In the insurance business, some periods may see a lot more activity than others. For example, for healthcare insurance policies, seasonal enrollment periods experience much higher volume. Therefore, policy goals (such as quotas) may need to be adjusted over time, depending on the calculation period.

Now, which policies should count towards attainment and so drive commission rates? You may choose one of the following:

- Attainment is based on policies which become active during the calculation period. Commissions are then paid on those active policies, within the same period.

- Attainment is based on policies which are submitted or approved during the calculation period. Commissions are then paid on those policies, within the same period.

- Attainment is based on policies which are submitted or approved during the calculation period. However, commissions are delayed until those policies become active, which could be in a different period.

If the timeline used for attainment is different from the timeline used for issuance of commissions, you need a way to calculated estimated commission amounts based on attainment, and delay payment of those estimated commissions until the appropriate condition is met.

How Much To Pay In Commissions For Insurance Policies?

Here are some typical numbers in the insurance business:

- Fixed per-policy amounts. Typical amounts range from $10 to $250 per policy.

- Percentage of annual premium. Typical amounts range from 5% to 15% of annual premium.

When an escrow-based system is used, typical percentages held range from 5% to 30%.

Often, the amount paid depends on the type of policy sold, agent seniority level, and insurance carrier.

How To Automate Insurance Commissions?

Here are some advantages an automated solution can bring to your business.

First, using a solution such as Sales Cookie, your incentive program will become more agile. Because you can visually configure incentive plans, it’s much easier to change tiers, thresholds, goals, quotas, rates, etc.

Second, using a solution such as Sales Cookie, it’s much easier to manage policy state transitions. Because a system properly tracks commission amounts, it becomes possible to reverse them and implement claw-backs correctly.

Third, you can motivate your agents by providing real-time visibility on their commissions. Instead of searching for and opening multiple spreadsheets, agents have access to their commission history (plus all pertinent details) online.

Visit us online to lean how you can automate your insurance commissions!