Here at Sales Cookie, we use software to automate commissions for many clients in the Technology industry. Customers routinely ask us: “So, what is the best commission structure to attract top talent? What’s the most popular bonus model you see in the technology industry?”. We hope this post will guide you to a competitive commission structure!

Typical Technology Sales Commission Structure – Overview

Commissions in the Technology industry are often based on Closed Won deals. Commissions are usually paid on the Annual Recurring Revenue (ARR) of each deal. However, commissions can include extra benefits to boost motivation. Some of these benefits include multi-year deal bonuses and accelerators once the reps have hit quarterly, half-yearly, and/or annual quotas. Renewals are also a common component in the Technology industry, usually paid at lower rates. However, they also keep motivation high for “farmers” as well as “hunters”.

Account Executives

Some key components we see include:

- A typical commission rate of 10% to 20% on Annual Recurring Revenue (ARR) over newly closed won deals.

- A commission bonus on multi-year deals. This can be calculated as a multiplier factor over the base rate. Usually, the multiplier factor is calculated based on the total years after the 1st year. For 3 years, it could be (36 – 12) / 12 = 2x.

- Sometimes, commissions will be over the contract value instead of the ARR.

- Sometimes, commissions will be paid in installments instead of just upfront.

- Accelerators to boost motivation. Typically those are based on quarterly, semi-annual, or annual targets. Accelerators incentivize reps to close more deals. Accelerators typically increase the commission rate by a calculated factor from 1.2x (under this, it’s not meaningful) to 2x the base commission rate.

- To keep reps engaged with existing customers, most companies offer incentives on renewals, usually at a lower commission rate (ex: 50% rate), and over the ARR (without accelerators).

- Some Technology companies also offer additional commission amount over professional services.

Here is an example of commission rules:

| Component | Example | Notes |

| Base Rate | Base rate of 10% | 12% for senior AEs |

| Multi-Year Deals | x1.5 for 2 years, x2 for 3 years | x1 for 1 year or less |

| Accelerators | x1.3 once you hit annual quota | Not retroactive |

| Renewal Rate | Fixed 5% (no accelerator) | Does retire quota |

| Pro Services | Fixed 5% (no accelerator) | Does not retire quota |

Business Development Representatives (BDRs)

A BDR is responsible for outbound lead prospecting.

- BDRs are usually compensated for discovering or qualifying opportunities.

- Most technology companies pay a flat cash rate per opportunity. Often this is different for discovery vs. qualification.

- Rules can get complex fast. For example, BDRs can receive accelerators for hitting monthly and/or quarterly quotas. This usually represents 1.2x to 2x the base commission rate.

- However, most companies do not pay a commission if a deal gets downgraded within the same period.

- Some companies will not double-pay over deals getting qualified and discovered in the same period.

Here is an example of commission rules:

| Component | Example | Notes |

| Discovered opportunities | Standard $100 | $120 for Senior BDRs |

| Qualified opportunities | Standard $50 | Customer must attend demo |

| Accelerators | x1.3 once you hit 25 opportunities / quarter | Retroactive to entire quarter |

| Downgrade from qualified | Claw back of original commission | On negative qualification |

| Special rules | Only 1 qualification per domain name | Duplicate contacts not allowed |

Inbound Sales/Sales Development Representatives (SDRs)

An SDR is responsible for inbound lead prospecting.

- SDRs are compensated for helping identify and close high-quality customers.

- Tech companies pay a flat cash rate per opportunity and there are typically accelerators as well.

- If a customer churns within the same month, the commission is clawed back.

Sales Managers and Vice Presidents of Sales (VPs)

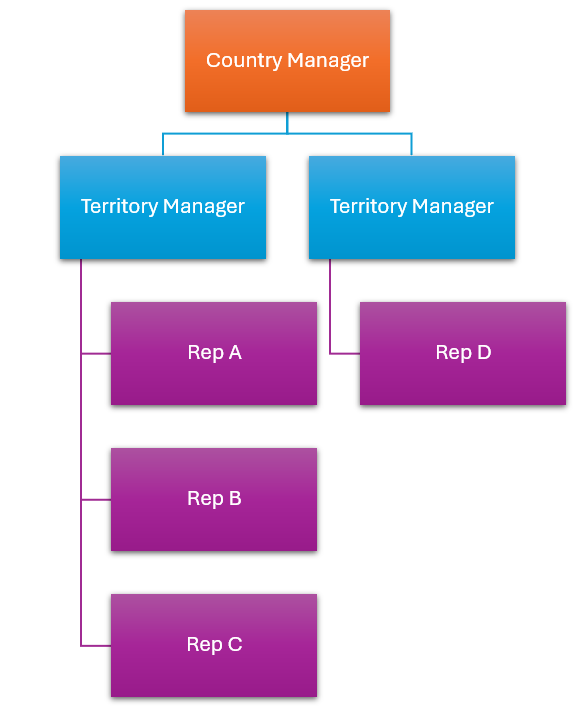

Usually, sales managers and VPs will receive commissions based on the performance of their team(s). This is called an “override” or “rollup” commission. Generally, this commission will be over all managed employees and/or independent agents. Additional incentives may also be offered depending on their teams exceeding performance. Sometimes, there are soft targets or management by objectives (MBO), such as customer satisfaction scores or churn rates.

Solution Engineers (SEs)

To keep the SEs engaged in projects they work on, Technology companies will also pay a commission to them. These rates generally range from 0.5% to 2% of the ARR. SEs actively support multiple deals, and this increases their motivation.

Challenges Associated With Manually Calculating Commissions and Bonuses

- Incorrect calculations – Calculating commissions correctly can be difficult if they depend on the ARR in conjunction with accelerators. Closed won deals can upgrade, downgrade, or change status to lost in subsequent periods. This requires tracking and accounting for frequent data changes, including potentially calculating year-to-date (YTD) ARR and only paying a delta and/or clawing back commissions. Implementing complex rules manually becomes a nightmare, e.g., SPIFFs based on overachievement for only one quarter, comparison of year-over-year performance, etc.

- Double-payment of commissions – If a company is unable to track whether a deal is moving back and forth across stages (from e.g. from lost to discovered or vice versa), it might cause the company to double pay and allow BDRs to “game” the system.

- Incorrect rollups – If a company is unable to stay abreast of individual role and/or team changes, override commissions can be tricky to calculate, especially if there are multiple layers of management.

- Delayed payments – Many companies only pay commissions when they get paid and depending on the business, this requires the reps to wait several months to be paid, which negatively impacts morale.

- Real-time visibility to commissions – If a company is manually generating, updating, and distributing commission spreadsheets, the risk of costly mistakes increases exposing the company to irate reps and potential lawsuits. Commission statements are not only static but also delayed. More reps are demanding ongoing visibility and transparency.

- Capping Commissions – Some companies cap commissions which discourages the top performers from exceeding their quotas.

- Single Point of Failure – Normally, only one person within the smaller companies handles all the intricacies of the commission calculations and statement generation. This person becomes a single point of failure and is hard to replace in case of an unexpected departure or illness or vacation.

Using An Automated Solution Such as Sales Cookie, Companies Can:

- Automate complex crediting, attainment, and payout rules.

- Reduce the time and effort required to calculate and process commissions significantly.

- Increase agility to easily adjust commission structure to match market conditions;

- Make the incentive program more exciting than the competition by being able to offer spiffs, contests, gamification, etc.

- Eliminate the need to manually generate, email, and archive commission spreadsheets.

- Provide real-time visibility and increase rep morale.

- Provide access to online and real-time commission statements.

- Track rep terms and conditions and inquiries in a centralized repository.

- Reduce the risk of a single point of failure.

- Reduce the risk of under/overpaying commissions.

- Reduce shadow accounting and legal exposure; and

- Become compliant with accounting standards.

Please visit us online to learn more. We look forward to helping you automate your incentives quickly and cost-effectively!