This article is to help you design a sales commission structure based on meaningful tiers. Here at Sales Cookie, we’ve seen thousands of commission structures! When our customers describe their tiers, we often ask them follow-up questions:

- Are your tiers cumulative or non-cumulative?

- What is the attainment period? Is it the same as the paid period?

- What is the attainment metric? Do all deals retire quota?

- Do you want to use blended rates for deals crossing tiers?

Why those strange questions? Well, even an apparently basic 2-tier commission structure can have subtle variants. In this post, we cover some of those nuances to help you choose the right tier structure. This will also help you communicate more precisely to your reps how your commission structure works.

How Many Tiers?

You could choose to have:

- No Tiers

- This option makes sense if you have a flat commission rate. For example, you pay 5% on all deals. It also makes sense if commission rates are based on individual deal sizes (not overall attainment). For example, if you pay 5% for deals whose value is under $5,000, and 10% for deals over $10,000, you have tiers. Note that such tiers are NOT based on overall sales attainment (in a given period) – they are only based on individual deal amounts. One key benefit of this approach is that you don’t have to think about quotas, since rules are per-deal. However, the major downside is that it does not allow you to reward reps based on sales volume.

- Two Tiers

- This option is a bit binary, but it can work if you want to keep things simple. It helps focus your reps on a simple goal – advance to the second tier. For example, you could pay 0% commissions under 80% attainment, but 5% once a rep exceeds 80% attainment (retroactive). Your 2 tier structure may not be exciting, but it will really motivate your reps to meet 80% of quota.

- Three Tiers

- This option allows you to introduce more nuance. For example, you could have a tier for 0-80% attainment, another for 80%-100% attainment, and another above 100% attainment. Each tier can have different rates / accelerators. This allows you to discriminate between poor, average, and high performers.

- Four+ Tiers

- This option allows you to introduce additional tiers to capture extraordinary performance. For example, you could have a tier for 0%-80% attainment, another for 80%-100% attainment, another for 100%-150% attainment – plus one final tier above 150% attainment, intended to reward exceptional performers.

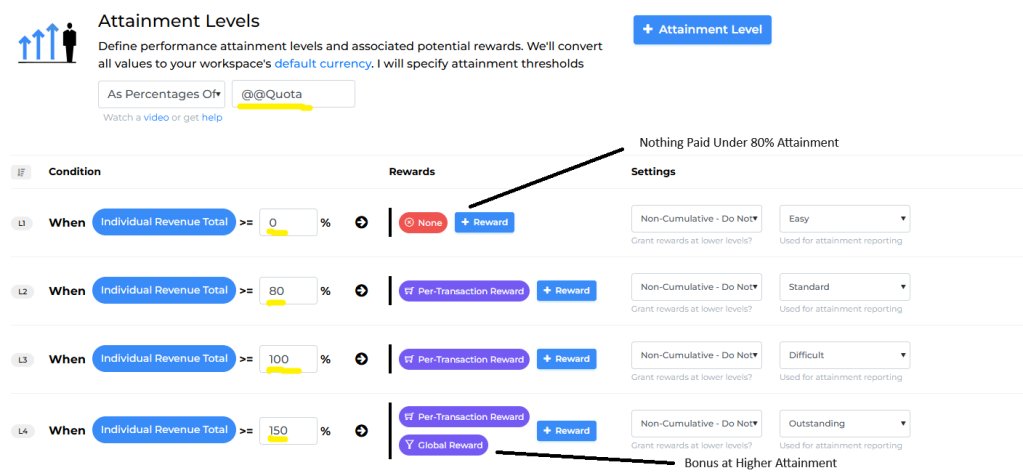

Here is an example of a commission structure with 4 tiers:

- < 80% attainment = no payout!

- 80%-100% attainment = 5% rate

- 100%-150% attainment = 7% rate

- > 150% attainment = 8% rate + $1500 special bonus!

Should Your Tiers Be Cumulative?

Tiers can be cumulative or non-cumulative:

- Non-cumulative = only the highest attained tier matters. This tier typically pays over all transactions in a retroactive manner.

- Cumulative = each tier is “stacked” on top of another. Each tier only pays over those transactions which fell within the tier.

Using the same example (above), if a rep attains 80%-100% of quota, you could say that you want to pay:

- 5% over all sold deals. In this case, the tier should be non-cumulative / retroactive. Basically, once reps reach 80% of quota, they get a payout on everything they sold.

- 5% over those deals which fell within the 80%-100% tier. In this In this case, the tier should be cumulative / non-retroactive. This could make sense if base pay already covers sales from 0-80% of attainment. In this case, you only want to pay a commission over those deals in excess of 80% attainment.

Many companies ignore this important nuance. They draft unclear commission agreements, which leads to disputes. For example, using the same example (above), if all tiers are non-cumulative, then a rep who reaches 150% attainment may expect to receive 8% over all sold deals! However, if tiers are in fact cumulative, then this rep should only receive 8% only over those deals in excess of 150% attainment. Other deals will be paid at a lower rate (5%, 7% respectively). This can make a big difference!

How Is Attainment Calculated?

To have tiers, you need an attainment period. The attainment period is the timeframe given to reps to meet certain goals / reach certain tiers. The attainment period could be different from the pay period.

- Ex: pay commissions monthly – and the goal is also monthly

- Ex: pay commissions monthly – but the goal is quarterly (QTD)

- Ex: pay commissions monthly – but the goal is annual (YTD)

- Ex: pay commissions quarterly – and the goal is also quarterly

- Ex: pay commissions quarterly – but the goal is annual (YTD)

Also, you need an attainment metric. Typically, the attainment metric is the same as the payment metric. For example, both attainment and payouts could be based on revenue. But those two metrics could also be different.

For example, let’s say your payout metric is revenue. You could decide to pay commissions over revenue from Renewal deals (at the applicable tier), but without giving credits (= quota retirement) for Renewals. In other words, Renewal deals will NOT help reps advance towards higher tiers (they do not retire quota / provide attainment), even though commissions will be paid normally based on whichever tier was attained. In this case, the attainment metric is different from the payment metric.

In the example below, we can see that $0 is given in attainment for Renewal deals, while still paying 5% over revenue.

Do You Want To Use Blended Rates?

Skip ahead if your tiers are non-cumulative (= only the highest attained tier matters). Otherwise, if your tiers are cumulative (= each tier pays over transactions which fell into the tier), you have to think about blended rates.

You could certainly represent payouts this way:

- You received $1,000 in Tier 1 commissions, with a 5% rate

- You received $2,000 in Tier 2 commissions, with a 10% rate

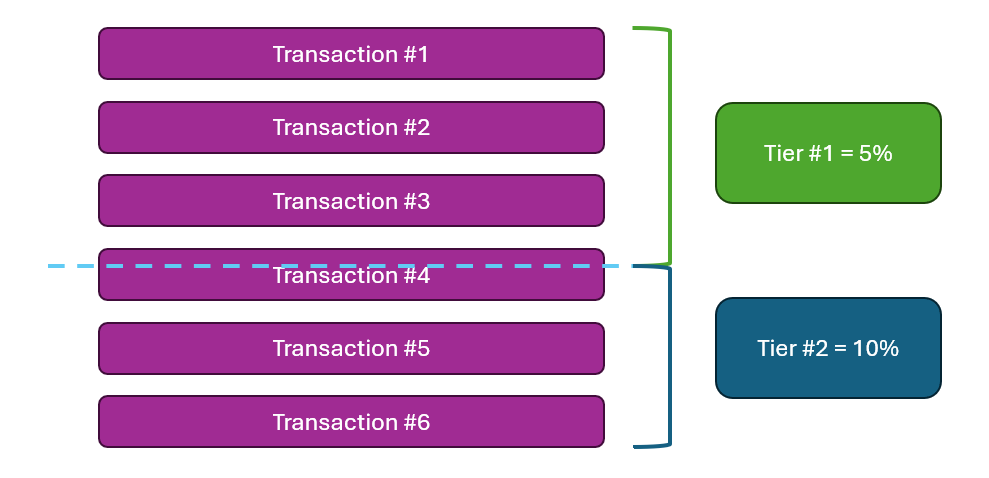

However, it’s much nicer to show to your reps how much they earned on each deal. Here lies the problem. Visualize a sequence of deals, and how they each fell within each tier. Some deals may cross tiers. So, a portion of a deal may be paid at a 5% rate (because partially still in Tier 1), but another portion may be paid at a 10% rate (because partially in Tier 2).

In the example below, we can see that deal #4 will be partially paid at a 5% rate and partially at a 10% rate. You have the option to use a blended rate – or to count deal #4 fully towards Tier 2. This is a decision you have to make. Typically blended rates make sense are are more correct.

More Impacts of Tier-Based Commissions

Please consider the following:

- Reps should not be able to game the system. If a rep artificially inflates sales during one period, they may reach higher attainment tiers, which could impact all deals. Even if commissions are clawed back later, all deals may have benefited from a higher commission rate, which is unfair.

- To have tiers, you must have attainment / quotas / goals. Setting quotas correctly can require significant effort to ensure they are neither too high nor too low. If you are not ready to define realistic quotas, don’t use tiers.

In Conclusion

In this article, we explained how to construct tiers for your incentive program. Sales Cookie can easily automate all variants (cumulative vs. non-cumulative, custom attainment metric, QTD / YTD plans, etc.). Please visit us online to learn more.